From Compliance to Strategy: How Tax Services Have Changed

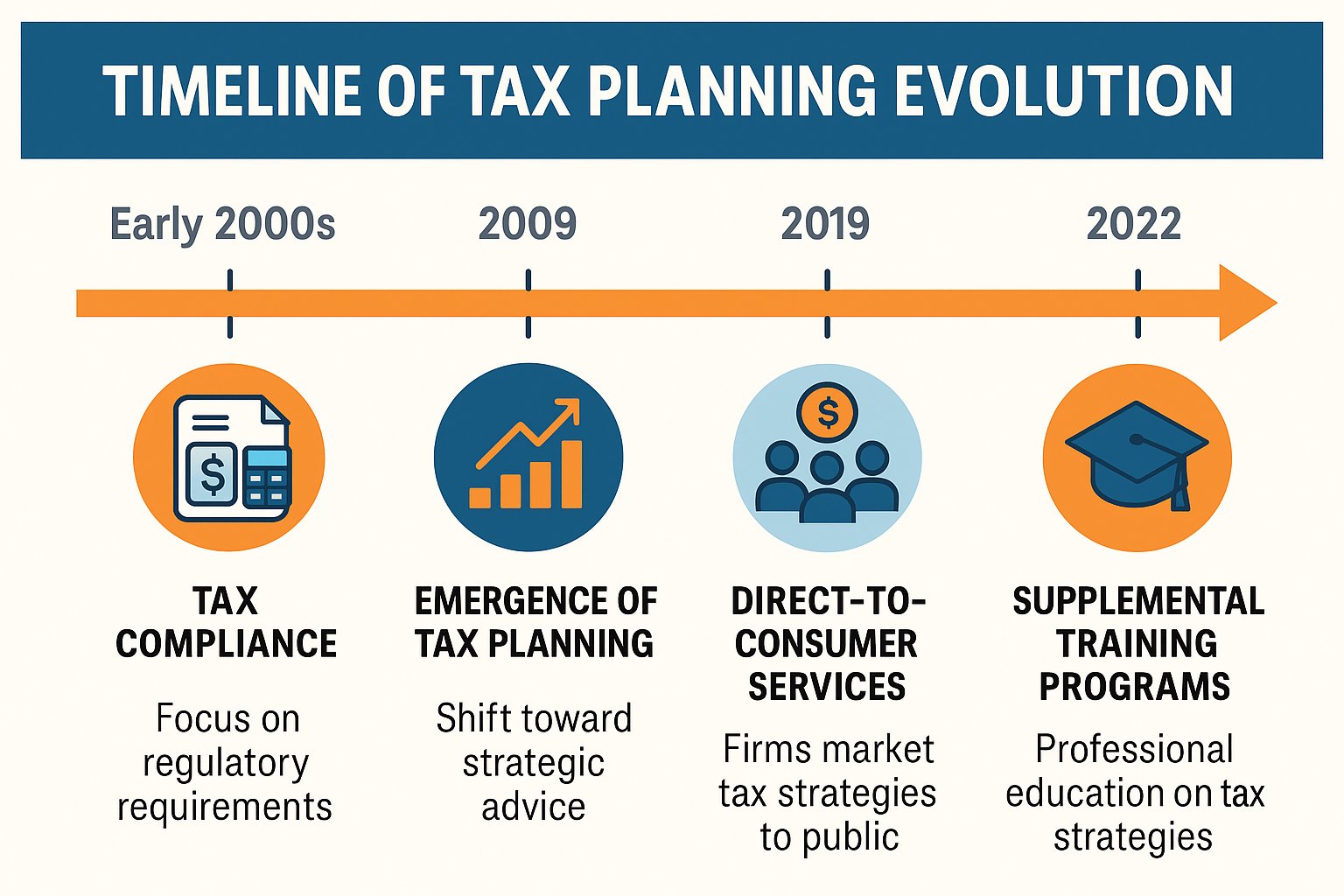

Twenty years ago, most tax professionals spent their time answering one question: “How much do I owe?” Today, clients ask a more complex one: “How can I pay less?”

This shift has redefined the role of tax professionals, moving the field from reactive compliance toward proactive strategy. As tax codes have grown more intricate and clients more financially savvy, advisors need new skills to keep pace. In response, an expanding landscape of educational tools, software platforms and training programs has emerged.

An important result of this evolution has been the democratization of tax planning. Once limited to high-net-worth clients or niche firms, strategic tax guidance is now more accessible to professionals across the industry. The rise of supplemental training and modern tools has made it easier for advisors to deliver planning services in firms of all sizes.

Importantly, these tools and programs aren’t intended to replace foundational credentials. Rather, they’re designed to supplement and build upon a professional’s existing education and experience. The goal is to help advisors meet growing demand for thoughtful, personalized tax planning.

Elevating Tax Planning Expertise

As tax complexity increased, CPAs, EAs and financial advisors began to receive more questions that extended well beyond filing. Many turned to continuing education and advisory tools to stay relevant and deliver greater value.

Today’s market offers three broad categories of support:

- Software Tools – Tax planning platforms help professionals save time and improve efficiency. Many automate client data intake, generate reports, and offer pre-built strategy templates. These systems can be helpful in identifying opportunities and streamlining communication, particularly for straightforward scenarios. However, they are most effective when paired with a strong understanding of the tax code and a strategic approach to client needs.

- Direct-to-Consumer Services – Some companies market bundled tax planning services directly to small business owners. These offerings aim to make strategy more accessible by combining entity formation, advisory, and filing support. While this model appeals to a certain segment of the market, it may provide less flexibility for practitioners who want to deliver customized solutions within their own firms.

- Professional Training and Certifications – Programs focused on continuing education are designed for professionals who want to sharpen their planning skills. These options often cover advanced tax reduction strategies, business advisory techniques, and client engagement best practices. Because they build on an existing foundation, they tend to offer more lasting value and broader application.

Where the CTBA Fits In

Launched in 2023, the Certified Tax and Business Advisor (CTBA) designation is one of the newest additions to this evolving ecosystem. Excel Empire created this program for professionals who want to deliver more strategic guidance in areas such as entity structure, retirement planning, and business advisory.

The program combines targeted education with practical tools and real-world case studies. Its purpose is not to replace a CPA or EA credential, but to help professionals expand their capabilities and offer deeper value to entrepreneurial clients. Like other leading programs in this category, the CTBA emphasizes education over automation and strategy over shortcuts.

Looking Ahead: The Future of Tax Planning Education

The evolution of tax services is ongoing. As client expectations increase and the regulatory environment continues to shift, professionals must remain agile and informed. The most effective resources will be those that help advisors think critically, communicate clearly, and build lasting trust with their clients.

Software tools and service platforms have a role to play. But for those who want to grow in their careers and deliver truly personalized advice, education remains the most powerful asset. Templates work until the tax code changes and without a strong foundation in strategic planning, these tools can only go so far. Investing in knowledge is not just a way to keep up with change. It is a way to lead it.